What Josh Hawley Gets Right

Here’s What You Need to Know

“Washington Republicanism lost big Tuesday night,” was Sen. Josh Hawley’s (R-MO) blunt assessment of last Tuesday’s election results. At first blush, it seems out of step with most assessments but digging deeper into which candidates won on what campaign messages, Hawley may be more right than many in Washington would like. In fact, it was a pretty good night for candidates at the extremes – as long as they were running in the right places.

Across the country, our analysts found that 88 of the 129 statewide races that can have significant impact on businesses and industries (U.S. Senate, Governor, Attorney General, and Treasurer) featured either or both a populist or progressive expressing skepticism if not outright hostility towards business. A populist or progressive has won or is leading in 69 of those races — more than three-quarters of races on which one or both appeared on the ballot.

In just 63 days, Congress and all but five state legislatures will begin their work. That means public affairs professionals cannot wait to prepare for what’s to come. Here’s what you need to know about the newly elected officials swept into office by the twin tides of populism and progressivism.

Meet the Faces of the Twin Tides

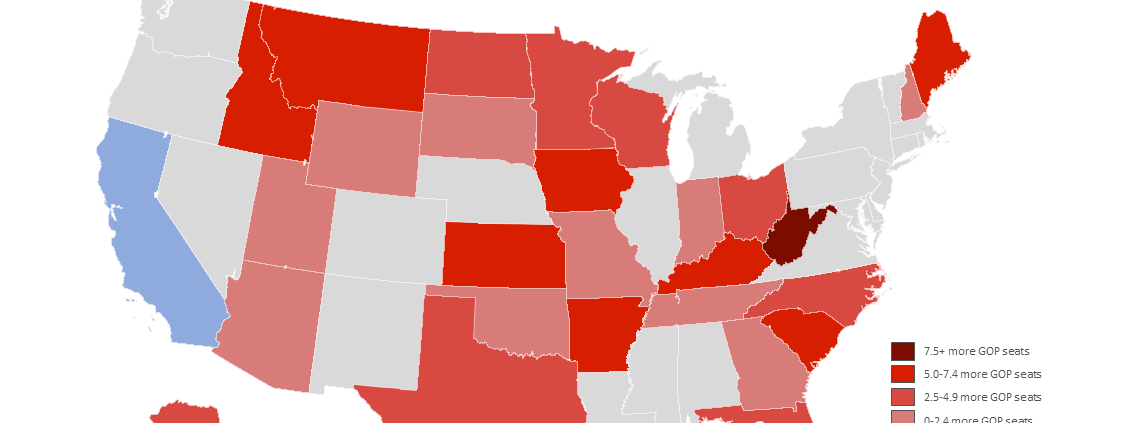

When the final ballots are counted, public affairs professionals will face redder red states and bluer blue states, straining even further the ability of businesses to achieve policy consensus and certainty. Here’s how this dynamic played out in the campaign.

26 of 35 U.S. Senate races featured populists or progressives, who won or are leading in 18 of those races. A number of those newly elected Republican Senators will attempt to out-Josh Hawley Josh Hawley, while newly elected Democratic Senator John Fetterman may become a model for full-throated progressive candidates. Indeed, Fetterman plans to “crack down on the big, price gouging corporations that are making record profits while jacking up prices for all of us … by prosecuting the executives of these huge corporations,” while Hawley’s new junior colleague from Missouri, Eric Schmitt, made clear in his campaign, “I’ve taken on Big Tech, Big Insurance, Big Pharma, Big Banks, Big Government. I’ve never been afraid of the tough fights.”

Sen.-Elect Katie Britt (R-AL)

“Globalists in D.C. have put us last for decades, and I am eager to set them straight and stand up for truly fair trade.”

Sen. Marco Rubio (R-FL)

“These corporations … should not look to the Republican Party for support. … Business and good government don’t have to be at odds. But if executive elites think they can force the rest of the country to support their insane policies, they have another thing coming.”

Sen.-Elect Eric Schmitt (R-MO)

“I’ve taken on Big Tech, Big Insurance, Big Pharma, Big Banks, Big Government. I’ve never been afraid of the tough fights. Missourians deserve a strong voice in the Senate who will take on the powerful on behalf of the people…”

Sen.-Elect Ted Budd (R-NC)

“Big Tech bias has gone too far in suffocating the voices of conservatives across our country. If these companies want to continue to receive legal protection, they should be forced to play by a fair set of rules in good faith. I’m extremely proud to join Sen. Hawley in this fight.”

Sen.-Elect JD Vance (R-OH)

“If you’re fighting the American nation state, if you’re fighting the values and virtues that make this country great, then the conservative movement should be about nothing if not reducing your power, and if necessary, destroying you.”

Sen. Alex Padilla (D-CA)

“With the growing consolidation of corporate power and increasing inequality amid record corporate profits, it’s evident that corporate greed is what’s increasing costs for American families …”

Sen. Raphael Warnock* (D-GA)

“Big corporations are raking in record profits while Georgians are forced to pay record prices. The business practices of a few corporations with overwhelming influence on our economy cannot be ignored.”

Senate Democratic Leader Chuck Schumer (D-NY)

“The bewildering incongruity between falling oil prices and rising gas prices smacks of price gouging and is deeply damaging to working people. The Senate is going to get answers …”

Sen. Ron Wyden (D-OR)

“Rather than investing in their workers, mega-corporations used the windfall from Republicans’ 2017 tax cuts to juice their stock prices and reward their wealthiest investors and their executives through massive stock buybacks.”

Sen.-Elect John Fetterman (D-PA)

“It’s time we crack down on the big, price gouging corporations that are making record profits while jacking up prices for all of us … by prosecuting the executives of these huge corporations …”

*Race will be decided in a runoff election.

16 of 36 Gubernatorial races featured populists or progressives, who won or are leading in 9 of those races. While not a numerous in races for Governor, populist and progressive governors are very prominent in the political discourse. Most notably, Republican Governor Ron DeSantis made clear in his re-election that “In Florida, our policy’s going to be based on the best interest of Florida citizens, not on the musings of woke corporations.” Across the country, Democratic Governor Gavin Newsom claimed, “Big oil is ripping people off at the pump … that’s why we need a price gouging penalty to hold them accountable and get these profits into your pockets.” After last Tuesday, they won’t be alone in their competing visions for their states and the country, or the pressures those visions place on companies and industries.

Gov. Ron DeSantis (R-FL)

“In Florida, our policy’s going to be based on the best interest of Florida citizens, not on the musings of woke corporations.”

Gov. Kevin Stitt (R-OK)

“ESG is kind of rewriting how you invest. Instead of focusing on value for your shareholders, it’s more of a political agenda… It breaks down the free market principles of capitalism that we’re used to in investing and so it’s anti-American.”

Gov. Greg Abbott (R-TX)

“Some Wall Street CEOs are divesting from fossil fuel businesses. That’s a two-way street. Texas is passing laws to divest from those woke businesses. We have the 9th largest economy in the world & we will use it to protect energy jobs in Texas.”

Gov. Kathy Hochul (D-NY)

“I’m the only candidate for Governor of New York who is committed to cracking down on polluters, cutting carbon emissions, and treating climate change like the crisis that it is. Our environmental progress is at stake in November.”

Gov.-Elect Josh Shapiro (D-PA)

“Shady corporations are taking advantage of Pennsylvanians. As our economy opens back up, they’re raising costs — and all for their own profits. I’ve taken on the powerful and well-connected my entire career. I’m not stopping now, and I’ll continue that fight as Governor.”

Gov.-Elect Katie Hobbs (D-AZ)

“With reports of price gouging from across the country, Arizona has been unprepared to combat exorbitant prices by unscrupulous retailers. Adding to the pinch that Arizona families are already feeling, gas prices recently hit record highs in June… even as the top 5 oil companies reported raking in $35 billion in record profits.”

Gov. Gavin Newsom (D-CA)

“Big oil is ripping people off at the pump, and they’re making more in profits off of Californians than in any other state – that’s why we need a price gouging penalty to hold them accountable and get these profits into your pockets.”

Gov.-Elect Maura Healey (D-MA)

“For far too long these, these corporations have tried to use the First Amendment to shield unlawful activity, serious fraud and misrepresentation both to the investor and shareholder, public as well as to consumers, which is what we allege that ExxonMobil did. So we’re gonna continue to fight on.”

Gov. Kathy Hochul (D-NY)

“I’m the only candidate for Governor of New York who is committed to cracking down on polluters, cutting carbon emissions, and treating climate change like the crisis that it is. Our environmental progress is at stake in November.”

Gov.-Elect Josh Shapiro (D-PA)

“Shady corporations are taking advantage of Pennsylvanians. As our economy opens back up, they’re raising costs — and all for their own profits. I’ve taken on the powerful and well-connected my entire career. I’m not stopping now, and I’ll continue that fight as Governor.”

24 of 30 Attorney General races featured populists or progressives, who won or are leading in 20 of those races, a worrying trend for an office we’ve noted has “blended legal action with political headlines on a wide range of policy issues.” On the Republican side, Arizona Attorney General candidate Abraham Hamadeh pledged, “As your Attorney General, we will fight back against the insanity of Big Tech, against the ‘woke’ left corporations who boycott states and condemn America but refuse to utter a word against China, and against Washington’s overreach into the daily lives of Arizonans.” On the Democratic side, Minnesota Attorney General Keith Ellison contended, “It’s my job as Attorney General job to help Minnesotans afford their lives in the face of the rising costs of prescription drugs, healthcare, and higher education; declining wages and purchasing power; scams, unscrupulous landlords, and pandemic profiteering; and fraud, deception, and antitrust practices by corporations.”

Attorney General Steve Marshall (R-AL)

“Big Tech is not the Ministry of Truth. It should concern us all when platforms that hold such tremendous power and influence over information wield that power in contradiction of — and with undisguised disdain for — the foundational American principles of free speech and freedom of the press.”

Attorney General candidate Abraham Hamadeh* (R-AZ)

“As your Attorney General, we will fight back against the insanity of Big Tech, against the ‘woke’ left corporations who boycott states and condemn America but refuse to utter a word against China, and against Washington’s overreach into the daily lives of Arizonans.”

Florida Attorney General Ashley Moody (R-FL)

“I’m sick and tired of corporations imposing their political will on unsuspecting consumers. As always, I will work with @GovRonDeSantis to ensure Floridians are protected.”

Attorney General Ken Paxton (R-TX)

“The ESG movement is the latest tool that woke corporations are using to push a radical and left-leaning social agenda into every corner of American life. It’s harmful to our state and nation, and it may be illegal as well.”

Attorney General-Elect Andrea Campbell (D-MA)

“As Attorney General … I’ll expose price gougers, protect your tax dollars & fight back against corporations that pollute our communities.”

Attorney General Dana Nessel (D-MI)

“While drug companies profit off of people’s health, they also benefit from a current market in which they control the pricing. Enough is enough.”

Attorney General Keith Ellison (D-MN)

“It’s my job as Attorney General job to help Minnesotans afford their lives in the face of the rising costs of prescription drugs, healthcare, and higher education; declining wages and purchasing power; scams, unscrupulous landlords, and pandemic profiteering; and fraud, deception, and antitrust practices by corporations.”

Attorney General Letitia James (D-NY)

“Throughout the pandemic, hardworking New Yorkers have been struggling to make ends meet, but big corporations have been celebrating record breaking profits. It doesn’t add up. My office is prepared to use every tool in our toolbox to crack down on price gouging and pandemic profiteering.”

Attorney General Rob Bonta (D-CA)

“CA is already experiencing the catastrophic effects of climate change. Corporations must pay for their role in the climate crisis.”

Attorney General Rob Bonta (D-CA)

“Plastic bag manufacturers must back up their claims or face enforcement action. As Attorney General, I’m committed to tackling the global #plasticpollution crisis and the corporations behind it.”

Attorney General William Tong (D-CT)

“Big Oil ignored science and peddled the use of fossil fuels, dangerously accelerating climate change. CT stands with Rhode Island @AGNeronha in his fight to hold these corporations accountable for their role in our climate crisis.”

Attorney General-Elect Anthony Brown (D-MD)

“Gas prices are rising, but the price of oil is falling. It’s price gouging, plain and simple, and it’s unacceptable. We need to get tougher on bad actors in the oil and gas industry taking advantage of hardworking Americans.”

Attorney General-Elect Andrea Campbell (D-MA)

“As Attorney General … I’ll expose price gougers, protect your tax dollars & fight back against corporations that pollute our communities.”

Attorney General Dana Nessel (D-MI)

“While drug companies profit off of people’s health, they also benefit from a current market in which they control the pricing. Enough is enough.”

Attorney General Keith Ellison (D-MN)

“It’s my job as Attorney General job to help Minnesotans afford their lives in the face of the rising costs of prescription drugs, healthcare, and higher education; declining wages and purchasing power; scams, unscrupulous landlords, and pandemic profiteering; and fraud, deception, and antitrust practices by corporations.”

Attorney General Letitia James (D-NY)

“Throughout the pandemic, hardworking New Yorkers have been struggling to make ends meet, but big corporations have been celebrating record breaking profits. It doesn’t add up. My office is prepared to use every tool in our toolbox to crack down on price gouging and pandemic profiteering.”

*Race remains to be called.

22 of 28 Treasurer races featured populists or progressives, and a populist or progressive won or is leading in all 22 of those races, highlighting how this once staid office has become the frontlines in the battle for and against ESG and other divestment measures. Utah Treasurer Marlo Oaks warned, “ESG is about controlling and forcing behaviors. It attempts to do through capital markets what activists and their government allies have been unable to do through democratic processes.” Conversely, Connecticut’s newly elected Treasurer Erick Russell pledged, “I am ready to make our progressive case … using our powerful voice as a key shareholder and investor to advocate for … combating climate change, advancing human and civil rights, promoting corporate diversity, and improving public health and safety through strategic divestment.”

Treasurer Kimberly Yee (R-AZ)

“We have the ability to go to companies that stand for the values that we believe in… ESG policies and woke corporations are moving in a direction that I believe is dangerous.”

Treasurer-Elect Mark Lowery (R-AR)

“First thing I would like to accomplish once in office is to continue … advocacy of investment strategies at all levels of government that disinvest from ‘woke’ investments including through BlackRock Investments.”

Chief Financial Officer Jimmy Patronis (R-FL)

“I was proud to join @GovRonDeSantis to deliver a simple message to the woke fund managers who keep investing in China: we intend to assert our seat at the table. Limiting our exposure to China is not only good for our country, but it’s the prudent thing to do.”

Chief Financial Officer Jimmy Patronis (R-FL)

“I believe ESG is un-American because global asset managers are using the woke-standards, to reengineer society, through billion-dollar industries. It’s undemocratic. Moreover, it appears it’s not confined to equities alone. It looks like insurance markets are beginning to write coverage based on ESG criteria. … We need to fight ESG within the insurance markets because it’s another theater of battle.”

Treasurer Julie Ellsworth (R-ID)

“[I am] working to stop undemocratic, woke efforts to implement non-financial or subjective criteria for measuring investment options & credit worthiness of legal businesses and individuals.”

Treasurer John Murante (R-NE)

“I took a stand against an attack on conservative free speech and was joined by several other State Treasurers. Conservative voices have a right to be heard and we will fight back against discrimination led by radical left-wing politicians and supported by woke corporations.”

Treasurer Robert Sprague (R-OH)

“As radical ESG-focused investment strategies continue to grab headlines, I want to make one thing clear – Ohio’s Treasury will not fall victim to it… In recent years, we’ve seen the Biden Administration weaponize its regulatory agencies and the finance sector as pawns to push their progressive agendas. Today’s ESG activism prioritizes political ideology over sound financial management.”

Treasurer Curtis Loftis (R-SC)

“I will not allow our financial partners to undermine my fiduciary responsibility to maximize investment returns while accepting a prudent level of risk for the benefit of our citizens. It is imperative that we stand up to BlackRock and resist the pressure to simply fall into line with their leftist worldview.”

Comptroller Glenn Hegar (R-TX)

“The environmental, social and corporate governance (ESG) movement has produced an opaque and perverse system in which some financial companies no longer make decisions in the best interest of their shareholders or their clients, but instead use their financial clout to push a social and political agenda shrouded in secrecy.”

Treasurer Marlo Oaks (R-UT)

“ESG is about controlling and forcing behaviors. It attempts to do through capital markets what activists and their government allies have been unable to do through democratic processes.”

Treasurer Fiona Ma (D-CA)

“I recognize that, for too long, capitalistic systems have unfairly and disproportionately rewarded the powerful and wealthy.”

Treasurer-Elect Erick Russell (D-CT)

“I am ready to make our progressive case … using our powerful voice as a key shareholder and investor to advocate for … combating climate change, advancing human and civil rights, promoting corporate diversity, and improving public health and safety through strategic divestment.”

Treasurer Deb Goldberg (D-MA)

“The pension fund invests billions of dollars in publicly-traded companies, and we want to do all we can to ensure these organizations are following best practices by affirming the science and causes of climate change… It is critical that we be forward thinking in building and implementing a comprehensive ESG framework that will have a positive long-term impact on our changing climate.”

Treasurer Zach Conine (D-NV)

“Today, I directed our team to divest the State of Nevada from any investment in a business that profits from the sale or manufacture of assault-style weapons. No one policy or law will fix this crisis, but we all must do something.”

Comptroller Thomas DiNapoli (D-NY)

“Achieving net-zero carbon emissions by 2040 will put the [state pension] Fund in a strong position for the future mapped out in the Paris Agreement. We continue to assess energy sector companies in our portfolio … Those that fail to meet our minimum standards may be removed from our portfolio.”

Treasurer-Elect James Diossa (D-RI)

“As Treasurer, I intend to leverage state funding in order to encourage cities and towns to adopt zoning and land use laws that encourage sustainable energy infrastructure. … Ensuring such projects move forward with an eye toward sustainability will pay long term climate change dividends.”

Treasurer-Elect Mike Pieciak (D-VT)

“[Fossil fuel investments are] a complicated issue, right? But I think everybody should be pro-divestment when you think of the financial risks that it’s going to present. So then it just comes down to when and how.”

Treasurer Curtis Loftis (R-SC)

“I will not allow our financial partners to undermine my fiduciary responsibility to maximize investment returns while accepting a prudent level of risk for the benefit of our citizens. It is imperative that we stand up to BlackRock and resist the pressure to simply fall into line with their leftist worldview.”

Comptroller Glenn Hegar (R-TX)

“The environmental, social and corporate governance (ESG) movement has produced an opaque and perverse system in which some financial companies no longer make decisions in the best interest of their shareholders or their clients, but instead use their financial clout to push a social and political agenda shrouded in secrecy.”

Treasurer Marlo Oaks (R-UT)

“ESG is about controlling and forcing behaviors. It attempts to do through capital markets what activists and their government allies have been unable to do through democratic processes.”

It’s Time to Act Before It’s Too Late

Companies and industries cannot wait to prepare for the onslaught of scrutiny that is lurking around the corner. With just 63 days until nearly all legislative sessions have begun, next year’s legislative sessions and executive actions will be developed and influenced sooner than you think. Understanding what shaped the 2022 campaigns is the first step. To know what you should do next, check out Delve’s newly released playbook, The Twin Tides Are Here: Your Playbook for What Comes Next, and grab one of the few remaining seats for tomorrow’s webinar on the new business landscape.

https://twitter.com/POTUS/status/1495911308625125380/photo/1

https://twitter.com/POTUS/status/1495911308625125380/photo/1