Blame Game Bingo

Here’s What You Need To Know

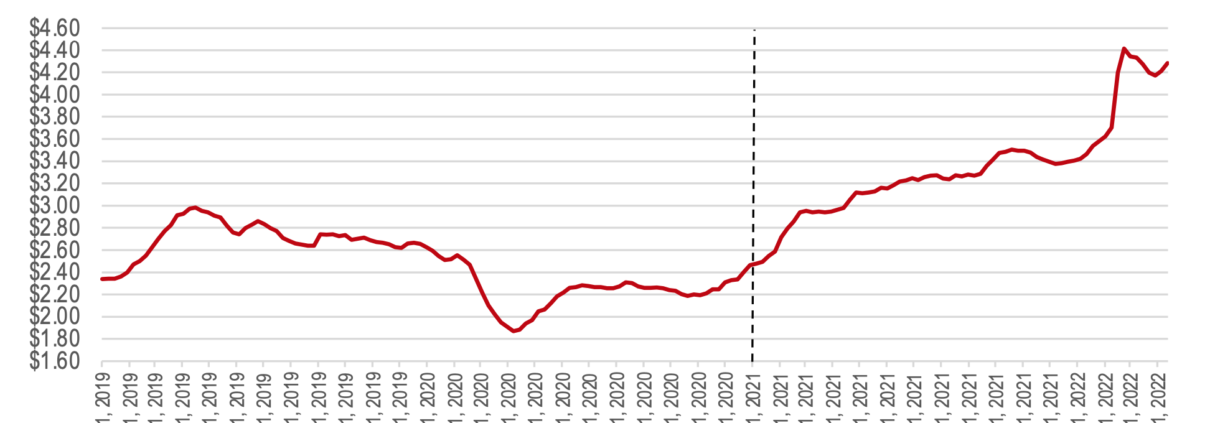

As oil majors reported a “big jump” in profits amidst record-breaking gas prices in the U.S.—where the average price for a gallon of regular unleaded gasoline hit its highest ever last month—the finger-pointing has reached a fever pitch over who bears responsibility for the pain at the pump, and not surprisingly, energy firms are caught in the partisan crossfire.

While President Biden and Congressional Democrats have dubbed it the “Putin price hike,” the truth is that gas prices have been escalating since the onset of the Biden presidency, a full year before the Russian invasion of Ukraine. Indeed, last year, the Biden Administration was demanding a Federal Trade Commission investigation of oil companies over price hikes and even now, Democrats in Washington are blaming oil company “price gouging” for the hikes.

Republicans, of course, lay the blame on Biden’s anti-fossil fuel policies, though factcheckers are quick to insist Biden’s steps since taking office “have had little [direct] impact on prices.” The reality, as is often the case, is more complex. While factors outside the control of either industry or elected officials are the main drivers of gas prices, the tone set by the Biden Administration has sent clear market signals that made it more difficult for producers to boost domestic energy production just as demand was swiftly recovering from the pandemic. As public affairs professionals in the energy sector navigate through this blame game, here’s what you need to know.

Subscribe to Receive Insights

"*" indicates required fields

What Is Really Causing the Price Hikes?

While Russia plays a significant role in global energy markets, and the country’s invasion of Ukraine certainly impacted gas prices, growing demand post pandemic, and a lag in energy production due to difficulties faced by oil producers in ramping up output, had been contributing to an upsurge that long preceded the incursion and remains a major contributor to higher gas prices. A review of average retail gas prices show they began an upward advance following Biden’s election, which coincided with the distribution of vaccines that signaled a reopening of the economy. More recently, a tight labor market is causing a shortage of crews, which has yielded a stock pile of drilled, but uncompleted wells (DUCs).

Presidential Policies Don’t Set Prices, but They Can Prevent Investment

While the Biden Administration and Congressional Democrats insist federal policies are not responsible for limiting oil and gas development, the Administration’s rhetoric – even today as they seek increased oil supply to reduce pain at the pump – has made clear fossil fuels’ days are numbered, and investment in oil and gas production would be disfavored.

Before taking office, Biden pledged to “take a whole-of-government approach to the climate crisis,” and within hours of taking office, Biden cancelled the Keystone XL pipeline. While the long delayed pipeline’s cancellation had little impact on short term supply, the decision sent a message that the new administration was not interested in new fossil fuel projects, even though the Administration now finds itself scrambling for another solution to increase oil imports from our neighbor to the north. Upon taking office, Biden also quickly moved to pause leasing on federal lands, another decision that may have marginal impact on overall supply, but made the Administration’s policy direction clear.

If it was not clear enough, though, Administration officials have put a fine point on matters. Biden’s climate envoy John Kerry earlier this year sentenced the natural gas industry to death in 10 years, regardless of whether renewable energy sources will be able to sufficiently replace natural gas a reliable resource by that date. More recently, White House National Climate Advisor Gina McCarthy insisted Biden is “absolutely committed to not moving forward with additional drilling.”

Meanwhile, the Federal Energy Regulatory Commission, now led by Biden-appointed Chair Richard Glick, issued a major overhaul of pipeline approvals and adopted sweeping new guidelines for natural gas ventures, including a first-ever new framework for evaluating projects’ greenhouse gas emissions. While FERC backtracked, the message to infrastructure developers was clear: new fossil fuel infrastructure is only going to get harder to build. At the Securities and Exchange Commission, Biden-appointed Chair Gary Gensler has been aggressively advancing new, far-reaching rules on climate disclosure requirements for companies both within and outside of the energy industry.

Investors Can Read the Signals, and Send Their Own

It is not just the Administration’s rhetoric or even the new SEC rules shifting investment dollars away from the oil and gas sector. Many investors have made commitments to reduce CO2 emissions—often as part of corporate ESG policies—on their own as well, even before President Biden took office. For years there has been a demand from investors for more clarity in how companies disclose their environmental impacts, and at the start of the new year, KPMG noted investors are “increasingly seeking greater transparency” in climate related disclosures. Further, while major Wall Street firms like Blackrock and Citi have rejected calls to divest from fossil fuels, it is only so they can continue to apply ESG pressures to such firms within their portfolios. In 2022 alone, Axios reports, “Investors have filed a record 215 climate-related shareholder resolutions.”

Not surprisingly, oil firms are quick to point to such investor concerns when asked why they aren’t increasing production. While these concerns are often framed as a need for more capital discipline, last year saw such financial concerns marry with environmental activism to upend Exxon’s board and shift its fossil fuel production strategy. This trend is not new. As we noted in early 2020, “Financial institutions have given into these growing social pressures and have adapted to avoid this risk … by planning to reduce the amount of capital available for … investments in fossil fuels.” More recently, a January BCG survey of 250 institutional investors found 57% felt pressured to divest from fossil fuels and 75% felt pressured to go “green” in their portfolios.

Where Do We Go From Here?

While the Biden Administration and Congressional Democrats point fingers at Putin and oil companies for rising gas prices, the reality is that policies adopted by the Administration—driven by commitments they made to activists in their political base— have led to higher energy prices and constrained supply. Now, as Democrats fear voters’ pain at the pump will lead to their pain at the poll, public affairs professionals in the energy sector will have to marshal the facts into a clear narrative about how we really got here, all while avoiding the ire of the administration, activists, and a wide range of other stakeholders that can impact the industry’s future.