Mind the Gap

Here’s What You Need to Know

Nearly 6 in 10 Biden voters and nearly 8 in 10 Trump voters agree that like-minded states (blue and red respectively) ought to secede and form their own separate country. Perhaps no other statistic better underscores “the great divergence” now under way, as red states get redder and blue states get bluer in this November’s election. This domination by one party in state governments mean fewer checks on partisan excesses and strains the country’s ability to form consensus where it can and compromise where it cannot, complicating a broadening range of issues for business.

With fewer representatives in government from the political center, companies will have to navigate a gap in policy direction between red states and blue states that on a growing set of issues has become diametrical opposition. Moderate Democrats who held back the excesses of progressivism and the free market mantra of Republicans that similarly curtailed populist impulses have both ebbed in recent election cycles, and the expectations for November suggest they will continue to fade. Here is what firms need to know as they prepare to navigate this widening divergence between the states.

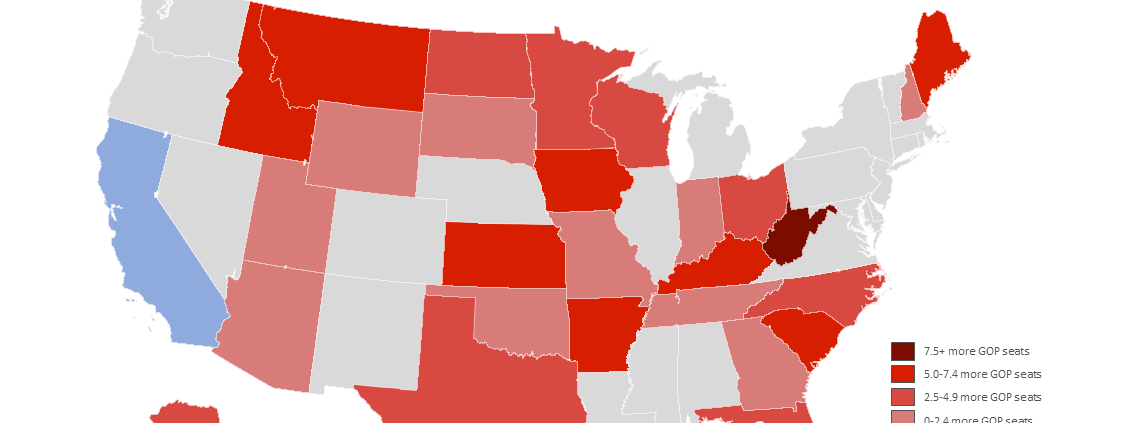

The Midterms Will Make Red States Redder and Blue States Bluer

When state legislatures are sworn in next year, majority parties are likely to grow even more dominant in more than two-thirds of state legislative chambers. Currently, 24 states have legislatures featuring a “supermajority” by one party and that number is likely to grow after this November. Furthermore, 37 state governments today feature a “trifecta” – where one party controls the governor’s office and both chambers of the state legislature. Only thirteen states have a government divided between the two parties. The gap between trifecta and divided state governments may expand after November too.

Subscribe to Receive Insights

"*" indicates required fields

While social and cultural clashes might seem like the obvious place businesses will get pulled between red and blue states, the pressures will not stop there. Companies can expect competing demands on a range of business and economic issues from both sides of the chasm:

- From paid family leave mandates to salary disclosure requirements to board member diversity quotas, and even whether to empower unions or embrace right-to-work laws, blue states and red states are diverging on a range of regulations affecting business operations.

- Blue states are divesting from fossil fuel companies, and red states are divesting from banks and asset management firms making environmental, social, and governance commitments that lead to reduced fossil fuels investment and financing.

- A number of blue states are following California’s decision to ban the sale of new gasoline-powered automobiles by 2035 even as red states are pushing back.

- Even in areas where there may be harmony between red and blue states, such as anti-trust legislation targeting Big Tech over content moderation and app stores, businesses will be caught in the middle.

- Likewise, on healthcare, blue states like California are seeking to manufacture their own generic drugs, while red states like Florida is pushing to reimport drugs from Canada.

As this gap in policy direction between red states and blue states expands, stakeholders and policymakers on both sides will crank up the heat on firms to take a stand even as they remain divided over what that stand should be. On a growing range of issues, companies will face immense pressure to conform and accept either the red or blue state version of reality.

In 2023, One in Four State Legislators Will Be New – And More Partisan – Including Key Chamber Leaders

Complicating businesses’ ability to navigate state legislatures and address competing pressures from diverging states will be the number of new members populating those chambers, many of whom will be more ideological than their predecessors. One in four state legislators sworn in next year will be freshmen, thanks to the highest level of open seats in five election cycles. This shift means businesses will start out the year with a bigger-than-usual task of acquainting themselves and building relationships with new policymakers who may be less familiar with issues impacting various industries and firms than their more seasoned predecessors.

Among these open seats are legislative leaders such as Arizona House Speaker Rusty Bowers, Rhode Island Senate Majority Leader Michael McCaffrey, and Wisconsin Assembly Majority Leader Jim Steineke. While the latter two decided to retire rather than seek re-election in the face of primary challenges, Bowers was one of numerous Republican incumbents to lose in primaries this cycle. Thus far, Republican incumbents have been losing state legislative seats at over twice the rate of the past two election cycles, generally to more populist challengers. While not to as dramatic an extent, Democratic incumbents are losing to more progressive challengers this cycle as well. More ideological state legislators mean fewer representatives focused on economic growth and business-friendly reforms rather than the latest front in the culture war.

These Dynamics Leave Businesses Caught in A Chasm with Fewer Allies

This increasing divergence between the states places businesses in a precarious position as they face mounting pressure from stakeholders on both sides of America’s cultural and political chasm. When businesses do take a stand — or no stand — they are bound to alienate a swath of policymakers and other stakeholders on various sides on the issue. Firms must understand that while they may have earned and maintained a great deal of trust, it will take a lot to ensure that trust withstands the growing wave of politicization.

As competing pressures from newer, more partisan faces in state legislatures arise, businesses will have to adjust how they approach their advocacy. They cannot wait for the election results to begin assessing risks and challenges or understanding what range of stakeholders and policymakers will shape those outcomes.