Trustbusting the Midterms

Here’s What You Need To Know

“Bring down the price … And do it now,” President Biden tweeted earlier this month, directing “companies running gas stations” to sell gasoline at cost. The demand defied logic (the majority of gas stations are independently-owned and have very low profit margins), but it did highlight how frustrated presidents can become over their limited ability to address economic headwinds hindering their party’s electoral prospects. If we have reached this level of rhetoric in early July, just imagine how heated things will get after Labor Day.

It is not just the price of gas drawing ire from elected officials feeling the heat from voters. Progressives and even more establishment Democrats are increasingly blaming corporations, from grocery stores to car companies and beyond for rampant inflation. As Congresswoman Alexandria Ocasio-Cortez (D-NY) told Yahoo! Finance, “A lot of these price increases are potentially due to just straight price gouging by corporations,” which the publication noted, “echoes comments in recent weeks from Sen. Sherrod Brown (D-OH), Sen. Elizabeth Warren (D-MA), and the White House.” Progressive voices, such as The Nation, have cheered on such claims, warning, “A failure to be blunt about profiteering leaves a void that will ill serve their party in 2022.”

While it ignores economic reality, left unchecked this rhetoric – and the accompanying policy responses – could cause lasting damage to companies and industries already struggling to hire workers, navigate supply chain disruptions, and prepare for a potential recession. Public affairs professionals cannot wait for the results of the midterms to stave off the lasting reputational and policy impacts. Here’s what you need to know to take action now.

Subscribe to Receive Insights

"*" indicates required fields

Profiteering Claims Aren’t Just Rhetoric – They’re Driving Policy Action

Blaming business for economic woes isn’t limited to rhetorical gestures—it’s manifesting itself in an agenda that is being pushed by the President, his appointees, and members of his party in Congress.

Anti-Trust Laws: Last year, President Biden was already laying the groundwork for Democrats’ midterm arguments, directing federal agencies to take investigative action to rein-in corporations, urging direct government intervention in a wide array of industries ranging from meat and poultry to oil production and announcing 72 new antitrust initiatives targeting a dozen industries. Many of these initiatives are being led by financial regulators who have a record of hostility towards the private sector that The White House nominated.

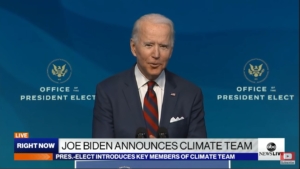

Presidential Appointments: The seeds of the current regulatory environment were sown with appointments made by Biden upon becoming President, including: Lina Khan, Chair of the Federal Trade Commission; Rohit Chopra, Director of the Consumer Financial Protection Bureau; and Jonathan Kanter, Assistant Attorney General of the Department of Justice’s Antitrust Division. All three have pursued a more aggressive approach to regulating firms.

Wage and Price Controls: In charging that companies are price-gouging, some Democrats are considering price controls as a remedy. In May, the House passed a bill banning “excessive” gasoline prices. Senator Bernie Sanders (I-VT) and five Democratic members of Congress have introduced legislation that would impose tax rate increases on companies with CEO to median worker ratios above 50 to 1, while some have called for implementing a maximum wage.

Ending Stock Buybacks: In April, Senate Democratic Leader Chuck Schumer (D-NY) and leaders of the House Oversight and Reform Committee demanded executives of major oil and gas companies stop stock buybacks and dividends to provide relief at the pump. Of course, suspending buybacks and especially dividends could make it even harder for oil companies to attract the capital required to fund expensive drilling programs that generate more oil. Beyond the energy sector, there had previously been a push among some Democrats to ban stock buybacks entirely.

What’s Really To Blame for Economic Woes?

As we wrote in May, in addition to Russia’s invasion of Ukraine, growing demand post-pandemic and difficulties faced by oil producers in ramping up output have been contributing to an upsurge in gas prices. Beyond the pinch at the pump, there are several factors driving inflation:

- Monetary Policy. The pandemic spurred unprecedented levels of stimulus spending, introducing trillions of dollars of cash into the American economy that would not be circulating under normal circumstances.

- New Spending Habits. After receiving stimulus payments and accumulating cash savings during the pandemic, American consumers now have greater purchasing power that is accelerating consumer spending.

- Supply Chain Issues. Even as Americans want to buy more products, they are unable to do so because the supply chain can’t produce and deliver enough of them. Producers must contend with skyrocketing prices for materials, labor, fuel costs, and shipping, ultimately weighing production costs with guesses on future consumer demand.

- Shrunken Workforce. America’s labor market is still recovering from the pandemic. Meanwhile, the federal government continues to extend eligibility for social safety net programs like Medicaid, food stamps, and unemployment insurance, which some scholars argue deters workforce reentry.

Despite Democratic focus on corporate profits, many economists, including those aligned with past and current Democratic administrations, say the price-gouging and antitrust zeal fails to understand the true nature of the inflationary spike, which they say are more a product of market forces and government policies than corporate greed.

As the Midterm Rhetoric Heats Up, Public Affairs Professionals Must Be Ready

Faced with unhappy constituents frustrated with the party in power, Democrats in Congress and the Biden Administration hope to refocus the conversation on “Big Business” profiteering, and no industry or company will be safe from scrutiny. That means public affairs professionals must be armed with the facts necessary to make their case to the public and policymakers about the current economic reality. Otherwise, damaging ideas based on false premises can gain traction and set the terms of debate for future policy proposals. The right competitive intelligence can equip public affairs professionals with the tools they need to anticipate and address such challenges with calm and confidence.