The Art of the (Trade) Deal

Here’s What You Need To Know

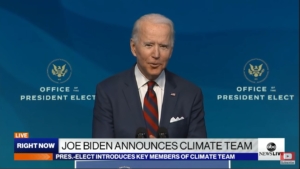

In 2016, then-candidate Donald Trump was able to leverage already growing angst on trade to advance his quest for The White House. Now, after nearly four years of trade wars, supply chain disruption, and sanctions, America has its greatest trade deficit in 14 years. Complicating matters is election year uncertainty about what the next presidential administration – be it a Trump second term or a transition to Joe Biden – will mean for how companies conduct business at home and abroad.

This uncertainty clearly has C-suites concerned, with a 2020 Conference Board survey of CEOs from around the world ranking trade disruptions as their second biggest external worry. In the U.S., corporate executives say it’s their fourth biggest worry, tied with the related issue of global political instability. This pain is felt here at home, according to the Mercatus Institute, which determined that uncertainty about shifts in trade policy has resulted in an approximate $53.4 billion decline in foreign direct investment flows to the U.S.

There is no question trade policy instability – already exacerbated by the pandemic – will keep public affairs professionals on their toes in the coming administration, no matter who wins. For the industries and coalitions impacted by trade, the debate is more than just tariffs and saber rattling. The future of America’s supply chain and relations with key allies and competitors around the world is at stake. To help these professionals anticipate what is next in the trade debates, here is what you need to know.

Subscribe to Receive Insights

"*" indicates required fields

The Trade Wars Have Only Just Begun

European Friends in Diplomacy, Foes in Trade?: While Joe Biden vows to end the “artificial trade war” launched by the Trump Administration against the EU, experts argue his trade policies would actually make matters worse, citing Biden’s penchant for “preferential treatment for U.S.-made goods, a long list of subsidies to domestic industries, and a ban on foreign companies from government procurement,” policies that Foreign Policy notes are often “widely abused by governments and corporations, and often lead to a spiral of retaliation by other countries.”

Fighting the Red Dragon: Both candidates are vowing increased pressure on China but have different ideas on how to get it done, a phenomenon the Los Angeles Times dubbed the “same diagnosis, different prescription.” The biggest difference, the Times explains, is that Biden would seek more international backing for any retaliation against China, while Trump acts independently. Of particular interest is what will happen to the Trans-Pacific Partnership (TPP), a 12-nation trade deal initiated by President Obama while Biden was vice president and from which Trump withdrew. Because so many Democratic lawmakers and leftwing activists opposed the TPP, it is uncertain whether Biden would consider reviving U.S. participation.

WTO Woes: President Trump has been very critical of the World Trade Organization, arguing repeatedly that the international body had been too soft on China, and his administration has, “undermined the organization’s highest dispute-resolution forum, the Appellate Body, by locking the nomination of new judges until in December [2019] it was no longer able to operate.” In retaliation, 17 WTO members, including the EU, Brazil, and China, set up their own parallel WTO court without the U.S. Undeterred by repeated measures from the WTO to stifle American action, Trump continued to criticize the organization and promised to act in American interests. While pro-trade advocates had hoped Biden would be a better ally than Trump, critics warn he won’t fix the system, but instead, advance policies similar to those from Trump.

The Next President Wants You to “Buy American”

A Trade Consensus … Sort Of: In the 2016 election, Donald Trump stressed the importance of rebuilding American industries. In 2020, both he and Joe Biden are making it a large part of their platforms. In fact, even Democrats once skeptical of protectionist measures enacted by the Trump Administration, including Rep. Earl Blumenauer (D-Ore.), are embracing a “Buy American” approach, urging Biden to consider maintaining some of the previous administration’s tariffs if he is elected. While their ideas may be different on how to transform trade, it seems that, at least for the foreseeable future, “Buy American” is politically popular (75 percent said they would support such policies) and will be around for a while.

It’s Still All About China: With the Trump Administration’s laser focus on China as the coronavirus culprit, a second Trump term would inevitably feature new punitive actions against the Asian nation. These actions extend far beyond tariffs, with President Trump banning federal contracts with companies that use Huawei and other Chinese companies and issuing an executive order attempting to force a sale of Tik Tok and restrictions on WeChat. The public overwhelmingly supports an anti-China approach, with record numbers of Americans holding unfavorable views of China. Even prior to the coronavirus outbreak, 77 percent said they thought tariffs were an important way to discourage U.S. companies from moving abroad. While both parties are open to tariffs, Republicans offer businesses via regulatory reform and tax reform as a carrot, while Democrats instead prefer fees and fines as a stick.

Coronavirus Spurs Continued Supply Chain Scrutiny: Harvard Business Review called the pandemic a “wake-up call for supply chain management.” Indeed, coronavirus has exposed how fragile our supply chain is, especially for delivering resources critical to public health and national security. The Department of Defense has long warned about the problem, with experts citing China’s role in manufacturing and distributing vital drugs, equipment, and supplies. Now, both political parties want to incentivize repatriation of critical industries to the U.S. The Biden campaign has announced a variety of rules it will implement, including filling the Strategic National Stockpile with American-made goods as much as possible. Meanwhile, the Trump Administration says supply chains should be entirely in the U.S. Critics argue that these measures are needlessly costly, while supporters insist it’s in the best interest of jobs and national security for the country. In either case, a variety of interests will want their voices heard, from labor unions eager to have a say in what those jobs look like to corporations trying to make sense of what tax, regulatory, labor and trade conditions may arise.

Sanctions May Shift From Snapbacks to Solidarity, but They’re Here To Stay

Iran Deal Drama: Much to the chagrin of European allies, the Trump Administration has acted aggressively to stop Iran’s global threat, backing out of the controversial Obama era Iran Deal, which the administration described as “one of the worst and most one-sided transactions the United State has entered into.” In 2019, the Trump Administration notified the U.N. Security Council that it would “restore virtually all of the previously suspending United Nations on Iran,” using a “snapback” provision in the deal used by the Obama Administration to assure wary Senators. This move drew the consternation of fellow U.N. Security Council members, and few allies have joined the renewed U.S. sanctions regime. Meanwhile, critics argued that restrictions on doing business with Iran make things difficult for the banking and energy sectors, while some scholars and progressive activists have promoted lifting sanctions to benefit both Iran’s and America’s economies. More hawkish voices continue to advocate against any step to normalize relations with Iran, a state they feel is hostile to American interests, allies, and security. While Biden has already promised to “offer Tehran a credible path to diplomacy,” there are no indications that Trump would back down from his strong stance on Iran.

Dealing with Bad Actors: Sanctions on countries engaged in human rights offenses and illegal economic practices are also likely to continue in the next term. The Trump Administration enjoyed broad bipartisan support for its sanctions on Venezuela, and Joe Biden says he’ll push for more sanctions against Maduro’s regime if they can be accomplished multilaterally. While existing sanctions are focused on thwarting public sector economic activity for the socialist regime, some worry that pressures could bleed into the private sector, affecting international businesses and important American trading partners, like India. America also has enacted sanctions upon China for a myriad of offenses, including its military aggression, illegal trade practices, and its ongoing persecution of religious minorities, including Uyghur Muslims. Sanctions are also being used to address China’s forceful takeover of the once-independent Hong Kong.

Russia, Russia, Russia: Meanwhile, many in Washington remain concerned about Russia’s growing influence in the world. Title III of the Countering America’s Adversaries Through Sanctions Act (CAATSA), sanctions Russian oil and gas, defense and security, and banking sectors in response to the country’s aggression in Ukraine and interference in the 2016 presidential elections. Democrats want to take that law a step further with the Defending Elections against Trolls from Enemy Regimes (DETER) Act as another way to punish Russia for what they feel was undue influence in the previous presidential election by banning these individuals from entering the U.S. Given the likelihood of continued Russian – as well as Iranian and Chinese – interference in the current election, the next president will be forced to weigh further sanctions on nations fundamentally at odds with American values while fortifying America’s and the world’s economies as they recover from the global pandemic.

Going at It Alone or Building Consensus: Conventional wisdom and history suggest it is effective to have multiple parties join in sanctions efforts. For the Trump Administration, wielding power via sanctions often meant “going at it alone.” With Democrats more interested in building international consensus, this could mean reversing key efforts by the Trump Administration that lacked support from other countries. This wildly different approach will greatly affect the ability of industries to forecast how policies may change with a new administration, and in particular, what thresholds will need to be met for major overhauls in trade policy.

Prepare for the Coming Upheaval

In an increasingly globalized marketplace, trade policy has never been more important – in politics and in business. The variability from one administration to the next, and an ever-changing list of friends and foes on either side of a policy, makes navigating these challenges even more difficult for the public affairs professionals representing industries doing business at home and abroad. Competitive intelligence is the key to seeing what’s around the corner and being prepared to meet it head-on. Delve stands ready to help you tackle the trade upheavals ahead – and anything else the next administration will bring.